Taxation when salary payment is deferred

A reader of this blog sent us the below question some days ago.

As per 192 TDS on salary is to be deducted on actual payment and not on accrual basis, here if a person resigns in Feb, his salary for the month of Jan and Feb is paid in April along with F&F settlement, then in which year it is accountable. As the payment is made in April [sic].

This is an important question which touches on one of the most fundamental issues in salary taxation – at what point in time should salary be taxed? When salary for the months of January and February is held back and paid only in April (a new tax year), how does Section 192 come into play?

A study of when salary should be taxed starts with Section 15 of the Income Tax Act. Let us take a look at Section 15 before we get to Section 192.

Section 15: Salary is to be taxed whenever it accrues or is paid, whichever is earlier

According to Section 15:

Salaries.

15. The following income shall be chargeable to income-tax under the head “Salaries”—(a) any salary due from an employer or a former employer to an assessee in the previous year, whether paid or not;

(b) any salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer though not due or before it became due to him;

(c) any arrears of salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer, if not charged to income-tax for any earlier previous year.

According to Section 15, salary should be taxed as soon as it accrues, even if it is not paid then. When can one say that salary has accrued? For example, can it be said that salary for the month of January accrues on the last day of January?

Salary is said to have accrued when it can be claimed by an employee from a legal standpoint. Statutes such as the Payment of Wages Act specify the deadline by which salary will have to be paid to an employee after a wage period (say, a calendar month) ends. One could argue that salary can be said to accrue at the end of a wage period. Surely, right to receive salary payment arises only when accrual is deemed to have taken place.

From the perspective of the employer, if salary for January is charged as an expense for the purpose of accounting in the month of January, one could state that salary expense accrues in January for the employer. In other words, the employer explicitly recognizes that the salary income to employee accrues in January.

So, what does Section 15 say with regard to salaries that are deemed (even if not paid) to accrue in January and February?

According to Section 15, income tax on January and February salaries should be calculated as per the income tax rates prevailing in the relevant financial year. For example, salary for January 2017 and February 2017 should be added to the total salary income of FY 2016-17 and income tax should be calculated as per the tax slabs mandated for FY 2016-17. This holds even if the January 2017 and February 2017 salaries are paid in April 2017 (in FY 2017-18).

What about Section 192?

According to the Income Tax Department, “Section 192 casts the responsibility on the employer, of tax deduction at source, at the time of actual payment of salary to the employee. Unlike the provisions of TDS, pertaining to payments other than salary where the obligation to deduct tax arises at the time of credit or payment, whichever is earlier, the responsibility to deduct tax from salaries arises only at the time of payment.”

It follows from the above that since tax deduction needs to happen at the time of salary payment, the remittance of tax too needs to take place only after salary payment.

While Section 192 talks about the timing of tax deduction, the quantum of deduction itself should be only as per Section 15. For example, tax on salary which accrues in January 2017 and February 2017 (see the question posed at the beginning of this post) should be calculated on the basis of the tax rates in FY 2016-17 even if the salary is paid late in April 2017. Section 192 states that the tax – which is calculated as per the rates in FY 2016-17 – needs to be deducted only in April 2017, the time of salary payment. This is important because the tax rates for FY 2016-17 (the period of salary accrual) could be different from the tax rates for FY 2017-18 (the period of salary payment).

One can summarize that Section 192 specifies the timing of tax deduction while Section 15 specifies the quantum of tax deduction.

Actually, Section 192 is in a bit of conflict with Section 15 particularly in cases where salary payment is made late, in the next financial year. We think the text of Section 192 should be rewritten to clear the confusion. Please see our blog post in this regard. Section 15 is what determines how much tax should be deducted.

Practical issues in complying with Section 192

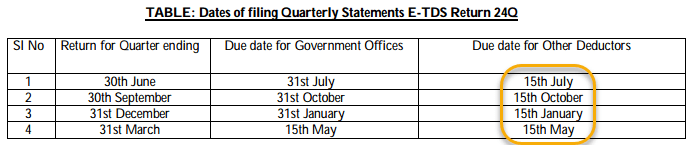

Even if salary for January and February is paid in the next financial year, the details of salary and TDS should feature in the fourth quarter Form 24Q of the financial year pertaining to the January and February salary. In case the fourth quarter Form 24Q has already been filed, one has to refile Form 24Q for the late salary payments.

Also, if accounting entries pertaining to January and February salary have to be finalised on time before the end of the year, the TDS amounts too have to be recognized in the books of accounts. However, this is not in line with Section 192 according to which the TDS payable arises only at the time of salary payment (in the next financial year).

Please note that, as a general rule, salary payment can be held back but payroll processing should never be stopped or deferred. For the months of January and February, PF, ESI and other statutory remittances can be made on time only if payroll processing is carried out without delay.

So, what do organizations do in case of delayed salary payment?

We find most organizations processing payroll and deducting/remitting TDS as soon as payroll is processed. This even if the net pay is paid along with settlement amounts at a later point in time. For example, in the example we are discussing in this post, the payroll of January and February salary shall be processed in January and February, and TDS for January and February shall be deducted and remitted to the Income Tax Department immediately. However, the net pay for January and February shall be held back and paid as part of settlement processing carried out in April.

While this is not fully in line with Section 192, this ensures compliance with Section 15 and that Form 24Q filing and Form 16 issuance are completed on time.

Some organizations misstate the period of accrual as the next financial year when salary payment is deferred to the next financial year. For example, let us assume that an employee’s last working day is 3rd of March and his final settlement consisting of March salary is processed in April. Some organizations calculate 3 days’ salary pertaining to March, state the same as April salary and include it in the income for the financial year in which settlement is processed. Of course, this is incorrect from the point of view of Section 15 of the Income Tax Act.

Ideally, organizations should aim to complete payroll/settlement processing without any delay. This would ensure compliance with income tax and other laws to a large extent.