Each year, employers issue Form 16, the statement of salary paid and income tax deducted, to employees, and employees use the information in Form 16 to file their income tax return (ITR) using a tax return form such as ITR-1. Until last year (AY 2017-18), the format of ITR-1 was such that employees could easily fill in ITR-1 on the basis of their Form 16 information. For AY 2018-19, the Income Tax Department has notified a new ITR-1 format which requires salary break-up information from employees. However, the Form 16 issued by employers for FY 2017-18 does not contain the salary break-up information. As a result, we have been receiving questions from a number of people on how they should go about filing their tax return for AY 2018-19 on the basis of their Form 16 information.

What is asked for in ITR-1 and what does Form 16 contain?

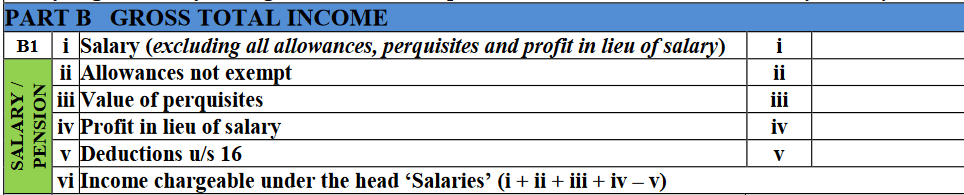

For AY 2018-19, ITR-1 requires the break-up of salary as presented in the screenshot below.

Employees, as can be seen in the above screenshot, need to submit information on salary (excluding all allowances, perquisites and profit in lieu of salary) and allowances to the extent not exempt from tax, separately. Form 16, given its current format, provides the total salary amount (including the allowance amount) without the break-up.

The Income Tax Department in its help file for ITR-1 suggests the following.

Fill the details of salary/pension, allowances not exempt, perquisites and profit in lieu of salary, deductions under section 16 etc. as given in TDS certificate (Form 16) issued by the employer.

This suggestion is not helpful since the Form 16 format, as prescribed by the Income Tax Department, does not contain the salary and the allowances not exempt amounts separately.

What should employees do?

Given that employees cannot fill in the income tax return form with information from just the Form 16, some experts are of the view that employees should take a look at documents such as payslips and tax workings provided by their employer for information required to file their return. Employees can take a look at their payslips and other documents for information. However, they have to be careful while filling in their tax return in order to submit the correct information. Any discrepancy between the total salary figures in Form 16 and the ITR form can lead to queries from the Income Tax Department.

Let us take a look at the break-up of the salary figure required for the ITR-1 form.

1. Salary (excluding all allowances, perquisites, profit in lieu of salary)

Please state the salary amount separately after excluding allowances, perquisites, and profit in lieu of salary. Hence, the salary figure for the purpose of ITR should include Basic pay, any annuity or pension, taxable gratuity amount, bonus, taxable leave encashment pay, salary advance, taxable employer contribution to Provident Fund, and taxable employer contribution to National Pension Scheme.

If the above figures are not clearly stated in your payslip or the tax working sheet provided by your employer, please seek information on salary break-up for the purpose of ITR from your employer.

2. Allowances not exempt

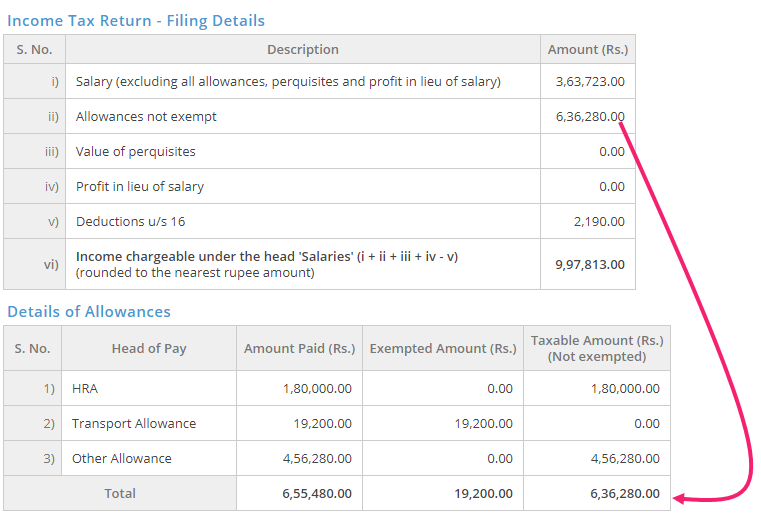

Please enter the total allowance value after exemptions such as those under Section 10 of the Income Tax Act. For example, if the House Rent Allowance (HRA) amount is Rs 1 lakh for the year and the exemption on HRA is Rs 0.50 lakh for the year, the net taxable amount of Rs 0.50 lakh (Rs 1 lakh minus Rs 0.50 lakh) should be included under the “Allowances not exempt” figure.

To reiterate, “Allowances not exempt” is not the total allowance amount you received under different allowance heads for the year. This should be the net amount after excluding exemptions such as those under Section 10 of the Income Tax Act.

3. Value of perquisites

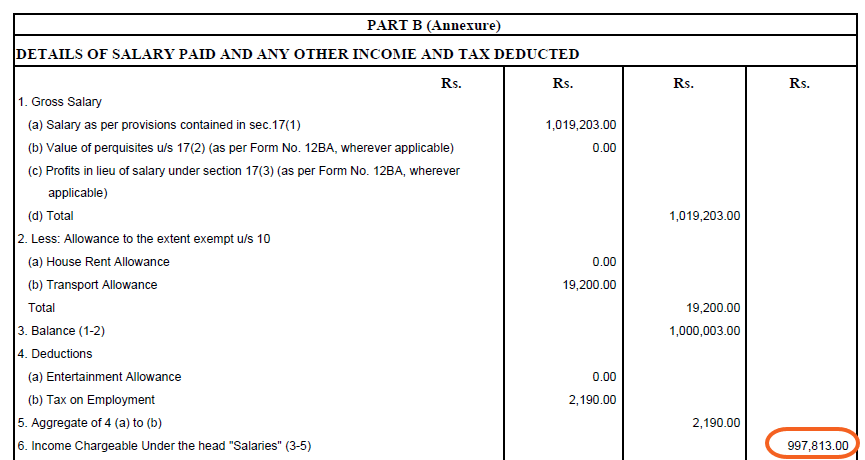

You can locate the value of perquisites under “Gross Salary” in Part B of your Form 16.

4. Profit in lieu of salary

You can locate the value of profit in lieu of salary under “Gross Salary” in Part B of your Form 16.

5. Deductions under Section 16

You can locate the deductions under Section 16 under “Deductions” (item number 4) in Part B of your Form 16.

Finally, please ensure that “Income Chargeable under the head ‘Salaries'” in your ITR equals the amount under “Income Chargeable under the head ‘Salaries'” (after Section 16 deduction) in your Form 16.

If you are a Hinote customer

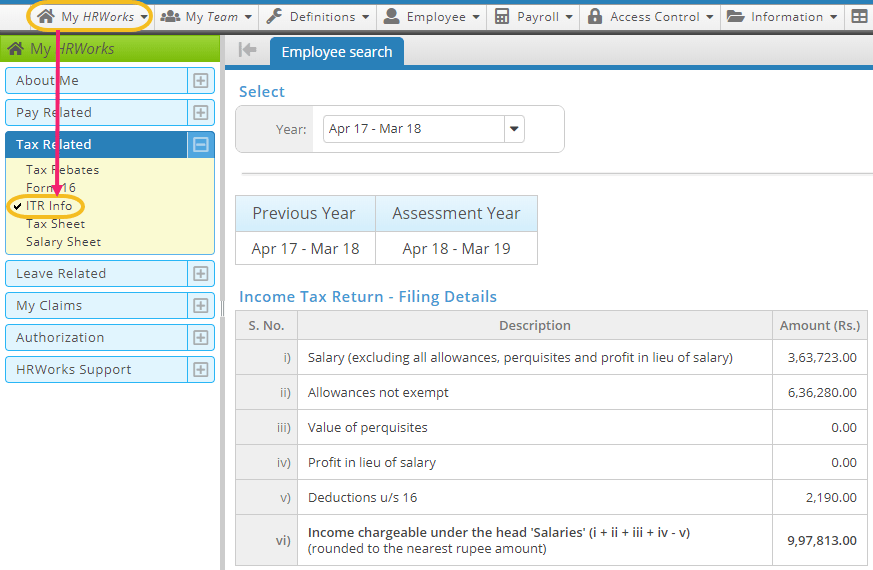

We have created a screen called “ITR Info” in HRWorks, our payroll portal, which presents the break-up of salary to help you file your ITR.

Please note that the amount shown under “Income chargeable under the head ‘salaries'” in the above screenshot should equal the amount under “Income Chargeable Under the Head Salaries” in Part B of your Form 16 as shown below.

The ITR Info screen also presents the break-up of your taxable allowances for your convenience.

8 Comments

Hi,

This is really informative and helpful. I have gone through so many online sites and videos for filing ITR, all those have different perspective. Some says Only Basic should be included in Salary (excluding all allowances, perquisite and Profit in lieu of salary).

One should go by the definition of Salary as per Section 17 of the Income Tax Act. Basic pay alone is not Salary.

My Salary structure has Special allowance, Which are fully taxable, So Should I write that amount under point ii) Allowance not exempt

Yes, you are correct.

Sir

1.Form 16 part B given by my employer put SCA AND TA under other sections of Chapter VI A which increases my deduction amount by 18600 is this correct as per your website SCA AND TA are under section 10

2. I file my return by putting SCA AND TA under exempt income section which comes the deduction amount the exact amount I have given to the employer. Will the department send me a notice under mismatch of deduction amount.? Please clarify and help me.

I am not sure if I understand your question. What is SCA? I presume TA refers to Transport Allowance. Exemption on allowances does not come under Chapter VIA deductions. Are you saying that your employer has shown exemptions on allowances such as TA under Chapter VIA deductions?

Our form 16 has an abbreviation of HRA, SCA, TA in Other sections under chapter VI

HRA and TA are House Rent Allowance and Travel Allowance

But what is SCA??

We are very curious to know the abbreviation meaning

SCA probably refers to Special Compensatory Allowance.