The Income Tax Department has notified the formats for the income tax return (ITR) for FY 2024-25. Employees who have claimed House Rent Allowance (HRA) exemption under Section 10(13A) of the Income Tax Act, are required to submit details of rent and salary in the ITR. The ITR calculates the HRA exemption on the basis of the details submitted by the employee. There is a possibility that the HRA exemption calculated in the ITR may not equal the HRA exemption calculated by the employer. Consequently, this could lead to a concern in the mind of the employee regarding the correctness of HRA exemption calculation made by the employer.

The difference in the HRA exemption amounts may also lead to notices getting issued by the department to the employee and the employer for no fault of theirs.

Issues with the HRA exemption calculation in the ITR

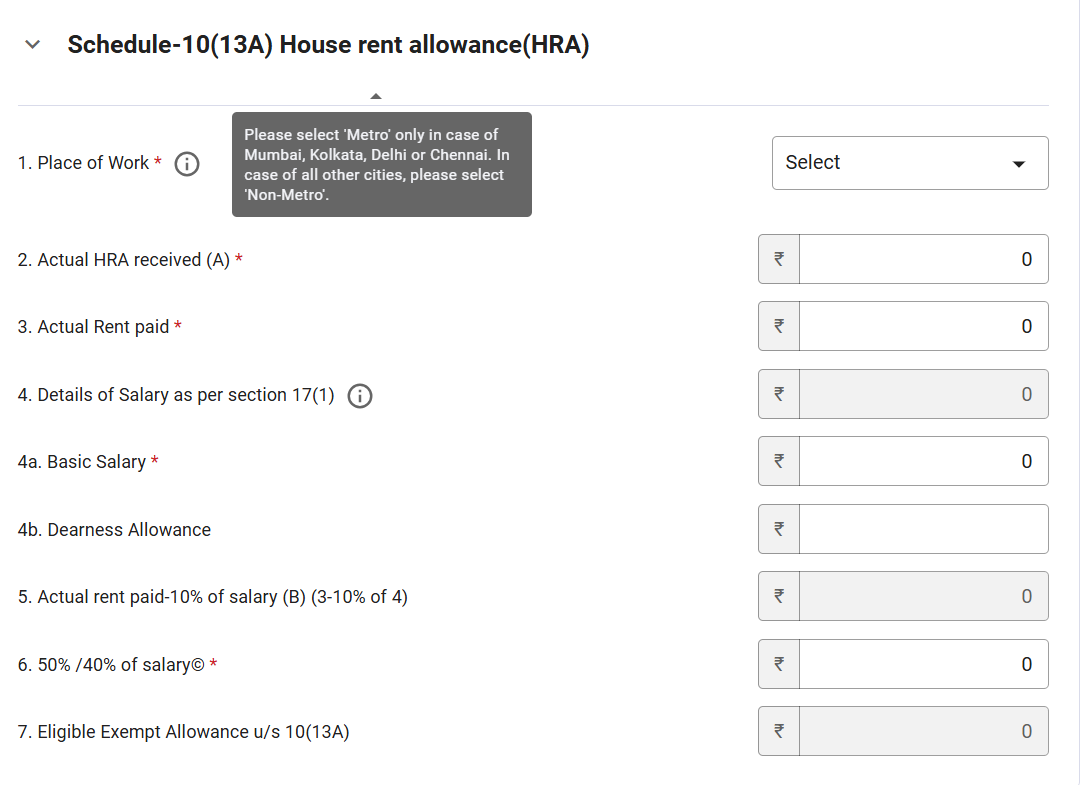

The initiative of the Income Tax Department to seek granular information to check the correctness of the HRA exemption amount is well taken. However, the manner in which the information is sought could lead to errors. The information sought by the department is presented in the screenshot of the ITR, below.

As you can see on the above screenshot, the ITR seeks details of all parameters for the purpose of HRA exemption calculation by way of the “least of 3” rule specified in Section 10(13A) of the Income Tax Act. The HRA exemption is calculated by the ITR in the field numbered 7 in the above.

Let us highlight the problems in this HRA exemption calculator.

1. Metro or Non-metro?

The ITR requires the employee to select either Metro or Non-metro for “Place of Work” (S. No 1 on the screenshot). Further, the employee is required to enter 50% or 40% of salary (S. No 6). This assumes that the employee has been in a metro city or a non-metro city/town throughout the year. What if the employee lived in both a metro and a non-metro city during the year? Should the employee enter 40% or 50% of salary? The HRA exemption calculated for both the metro and the non-metro city will not match with the ITR calculation whether the employee enters 40% or 50% of salary.

2. Confusion regarding “Place of work” (S. No. 1).

The employee is required to choose between Metro and Non-metro for the “Place of work” field. The metro/non-metro choice should be for place of stay (rental accommodation) and not place of work. We are not sure why the department is seeking information on the place of work.

Let us assume that an employee stays in a metro city and works at a non-metro place. For place of work, the employee will have to enter “non-metro” in the ITR while for HRA exemption calculation, the employee will have to enter an amount equal to 50% of salary since they stay in a metro city. Will the department flag this as incorrect HRA exemption calculation on the basis of the place of work choice?

3. HRA exemption calculation at the annual-level could lead to mistakes.

We dealt with HRA exemption calculation in an earlier blog post. Kindly take a look at it to understand the issues related to HRA exemption calculation.

The ITR requires entry of HRA and the other amounts at the annual level. As we mentioned in the earlier blog post, the problem with calculating HRA exemption by consolidating numbers at the annual level is as follows.

This method requires employees to submit the total rent amount paid during the year and use the annual rent amount for calculation. If an employee has a full month loss of pay in a month, say, September, the rent for September is also included in the annual rent figure. If in September, the employee received zero HRA on account of loss of pay, how can the September rent be included for HRA exemption calculation? In other words, how can rent be considered for a period in which there is no HRA and consequently no HRA exemption?

If an employee enters all the numbers at the annual level in the ITR, there may be several instances where the HRA exemption calculated in the ITR would differ from that calculated by the employer for TDS calculations. Consequently, the ITR calculations may point to an over or under deduction of income tax for no fault of either the employee or the employer.

If an employee has worked across multiple employers in a year, the total of HRA exemptions calculated across employers may not tally with the HRA exemption amount calculated in the ITR.

If the HRA exemption calculated by the employer is lesser than that calculated in the ITR, will the department provide the higher exemption to the employee or will it seek more information from the employee or the employer?

If the HRA exemption calculated by the employer(s) is greater than that calculated in the ITR, will the department send notices to the employer(s) seeking an explanation?

We are concerned that the inadequacy in the HRA exemption calculator in the ITR may lead to confusion in the minds of the stakeholders.

A suggestion

If the Income Tax Department wishes to collect information on HRA exemption amounts, it should seek details of HRA exemption calculation from the employers who do the calculation for the purpose of TDS.

In the ITR, the HRA exemption calculator should contain multiple rows – one for each period of HRA exemption calculation – so that the employee can provide granular details of Salary, HRA, rent for each period of HRA exemption calculation instead of aggregating the amounts at the annual level.