Someone asked us a question on Form 16 recently.

In case an employee has no tax liability and hence no tax is deducted from the employee’s salary, can/should the employer issue Form 16 to the employee?

The typical answers we come across are as follows.

a. Form 16 cannot be issued to an employee with zero tax. This is because Form 16 can be generated only if tax is deducted from an employee’s salary.

b. Part A of Form 16 cannot be issued while Part B alone can be issued.

Both the above answers are wrong.

The question has 2 parts – whether an employer can issue Form 16 to a zero tax employee and whether an employer should issue Form 16 to a zero tax employee.

Can Form 16 be issued?

A Form 16 comprises 2 parts – Part A (downloaded from the TRACES site) and Part B (prepared by the organization issuing Form 16). Any organization can create Part B. However, for Part A to be available on the TRACES site, an organization has to include the employee record (including zero tax employees) in Annexure II of the fourth quarter (Jan – Mar) Form 24Q. You would be aware that Part A also contains information on salary paid to an employee and the tax deducted from an employee’s salary for each of the 4 quarters. Hence, for the salary and tax figures to appear in Part A, the employee record should also feature in Annexure I of Form 24Q. In fact, the employee record need not feature in Annexure I in Form 24Q of all quarters. Please note that if the employee record features in Annexure I of only one Form 24Q and Annexure II of the fourth quarter of Form 24Q, his Part A will be available for download on the TRACES site. Just that the fields (in Part A) pertaining to salary and tax amounts for the quarters in which the employee record is not included in Annexure I will be shown as blanks.

Once Part A is downloaded from the TRACES site, the organization can create Form B, and issue the signed Form 16 to a zero tax employee.

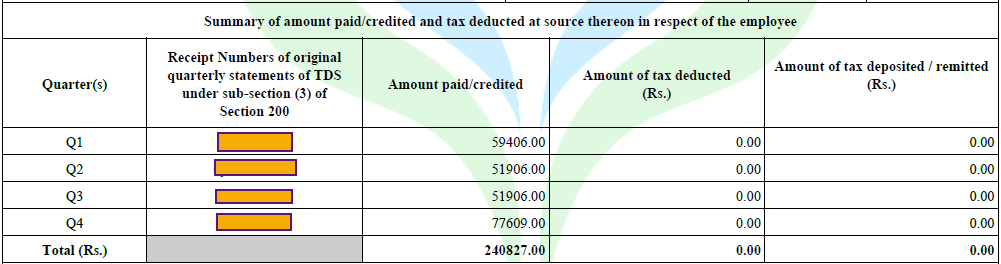

Here is a screenshot of Part A for an employee with no TDS.

So, can Form 16 be issued to a zero tax employee? Of course, it can be issued!

Should Form 16 be issued?

As per the diktat issued by the Income Tax Department, an organization need not include an employee record in Form 24Q until the quarter any tax is deducted from the employee’s salary. Once tax is deducted in a quarter, the employee should feature in Form 24Q for that quarter and the subsequent quarters until end of the year as long as the employee receives salary, even if no tax deducted in any of the subsequent quarters. Let us explain this with examples.

An employee works for the entire year and receives salary for all the 12 months.

1. Tax deducted in the first quarter.

The employee should feature in Form 24Q of all 4 quarters.

2. Tax deducted in the third quarter; no tax in the first 2 quarters.

The employee should definitely feature in Form 24Q of third and fourth quarters. The employer can choose to include or exclude the employee in Form 24Q for the first and second quarters.

3. No tax deducted in all four quarters.

The employer, at their discretion, can choose to include or exclude the employee record in Form 24Q.

So, should Form 16 be issued to a zero tax employee? It is up to the employer.

Since it is not mandatory for zero tax (for the whole year) employees to feature in Form 24Q, many employers do not issue Form 16 to zero TDS employees. However, there are also many employers who issue Form 16 (with both Part A and Part B) to zero TDS employees.

A word on the department’s diktat

We wonder why the Income Department does not insist on employers including zero tax employees in Form 24Q. Form 24Q presents not only tax figures but also salary figures. There can be instances where the Income Tax Department may never get to know instances of tax evasion because of this.

For example, let us assume that an employee works for 2 employers in the year 2016-17 and receives Rs 2.4 lakh from each employer. Both the employers do not deduct tax since the employee receives a salary which is in the zero tax bracket and both the employers decide not to include the employee record in their Form 24Q filings for the year.

This is a case where an employee receives Rs 4.8 lakh in a year and is liable to pay a certain tax. Since the employers do not show the employee record in their Form 24Q filings, the Income Tax Department will never get to know the salary of the employee. If the employee does not pay the tax by himself and file his tax return, the Income Tax Department may never be able to levy tax on the employee’s salary.

The whole process of Form 24Q needs a revamp. But that is a topic for another day.

46 Comments

Hi Gautam,

I always search your blog on recent updates and informative topics shared by you. Loved it every time you share. Keep posting and wish you all the best.

The best thing is you always respond with our quires.

so here it is one more for you :

How we treat NPS employer contribution in Form 16 an 12BA.

1. Thank you for your kind words.

2. NPS employer contribution under Section 80CCD(2) should feature in Form 16 (Part B) in 2 places.

a. The total NPS contribution shall be added to the gross salary.

b. The actual deduction as part of “Deductions under Chapter VI-A” under “80CCD” after applying the 10% limit rule.

3. NPS employer contribution will not feature in Form 12BA.

but in few articles and HDFC site on NPS says it will be added as Perquisite,but i have not find anything on the treatment in Form 12BA.

If i contribute 1 lac from my end, 50K is considered in 80CCD(1B) and rest 50K can be utilized under sec80C ?

“but in few articles and HDFC site on NPS says it will be added as Perquisite,but i have not find anything on the treatment in Form 12BA.”

Ans: I am not sure about this. If you can forward the link to the articles, I can take a look.

If i contribute 1 lac from my end, 50K is considered in 80CCD(1B) and rest 50K can be utilized under sec80C ?

Ans: Yes, that is the way to do it in order to give the employee the maximum benefit.

https://www.hdfcpension.com/nps-for-nri-oci/

http://www.simpletaxindia.net/2012/10/deduction-new-pension-scheme-cpf.html

One more question regarding Gratuity :

Taxability of Gratuity in case of Death

1. Not sure why the articles you have quoted from refer to 80CCD contribution as perquisite. Section 17 of the Income Tax Act very clearly specifies employer contribution to NPS under 80CCD as “salary” and not “perquisite”.

2. Taxability of gratuity on death.

In the event of death of an employee, taxation of the gratuity paid to the spouse/legal heir of the employee shall be as per Section 10(10) of the Income Tax Act. In other words, the exemption shall be the least of the following:

a. 15 days’ salary for every completed year

b. Rs 10,00,000

c. Gratuity amount actually received.

so if gratuity of 20 lacs is paid to spouse/legal heir, 10 lacs is exempted and on 10 lacs tax at applicable, but here on whose account tax will be deducted and form 16 is issued.

The gratuity amount shall be paid to the beneficiary. The beneficiary shall pay tax on the taxable gratuity amount under Income from Other Sources.

Dear Sir,

My salary is 20K & but if you can tell me what is the maximum salary to avail ESIC.

Regards

AJ.

As of now (Oct 16), the salary limit is Rs. 15,000.

The ESI limit increased to 21000 wef from 1st Oct. The notification is issued.

Not sure which notification you are referring to here. The 06-Oct-2016 notification issued by the Min of Labour only seeks views on the wage limit enhancement for ESI. Hence, to my knowledge, the limit stands at Rs 15,000 currently. Please provide the link to the notification you have referred to, for our benefit.

http://blog.scconline.com/post/2016/10/08/the-employees-state-insurance-central-amendment-rules-2016-notified/

These are just draft rules and have not been implemented as yet. We need to wait for final notification which will be issued after the government receives feedback on the draft rules.

so we cannot implement this from this month payroll.

if so, how we will adjust if it is from 1st Oct and notification will be issued next month.

We need to wait for the final notification. The implementation may be prospective and not retrospective.

Dear Sir,

We didn’t deduct the tds for our three employee for the F.Y 2012-13. Now we found that mistake and willing to pay tds with interest & penalty. We know we have to pay TDS non deduction penalty (Equal to TDS Amount), Non filling return penalty (Equal to TDS Amount)& Late payment Interest. Am I right? if not pls correct me.

And what about late TDS certificate (Form 16A) penalty which is Rs100 per day. Is there any maximum limit for this penalty. If not we have to pay more than Rs.1,00,000 (1000 days are already past). And pls clarify me whether we have pay that penalty for each employee (3) separately that is more than Rs,3,00,000

Thanks in Advance

The penalty (Rs 100 per day) under section 272A(2)(G), which pertains to delay in issuance for Form 16, shall not exceed the amount of tax deductible.

Dear sir

I am not filing tds return form16 for period of 2016-17. Now filing the return for period of 2017-18 4th qtr. if any penalty applicable

My total income 175000 on period of 2016-17.

There is no penalty.

Hello Mr . Gautam ,

Is it Mandatory to include the name of the staff members , whose salary is below thershold limit in the form 24 q in every quarter .

pl. explain

thanks

It is not mandatory, subject to the below.

In case there was tax deduction for an employee in a previous quarter, the employee should feature in the current and future quarters until the end of the year irrespective of whether the employee has any tax deduction.

Hi…

in my payslip tax not deducting because i have submitted my insurance bills and medical bills.

now i want to switch company so that i asked form16 now HR telling that in your payslip income tax not detecting so you wont get form16

Now new company asking form16 …. what i have to do please help me…

Please ask your previous employer to provide a tax working sheet. You can submit the tax working sheet to your new employer.

Hi sir

I need to e-file ITR for 2015-16financial year. I don’t have form 16 part B annexure. I have only form 16part A. It gives gross income and tax deduction. Information regarding split deduction not available. How to generate form 16 part b for financial year2015-2016. Is it available online.

You need to get Part B from your employer.

Hi,

Can we generate form 16 for an ex-employee to whom only FnF amount is paid in first quarter? 24Q4 – Annexure II have 2 fields, “Date from which Employed” and “Date to which employed” and these 2 are mandatory fields. Since the employee was not employed with the company for current financial year, what should be these 2 dates? I think, IT department rejects such records while processing TDS returns with records having employment dates in past year.

Thanks in advance.

We have successfully filed 24Q4 where employment dates from past years have featured in later years’ 24Q4 annexure II. Hence, I do not think employment dates from past years is a problem.

Thanks, Gautam. Let me try.

My current salary 3 Lakhs, but my current company was never detected tax from my salary. I got new opportunity with MNC company. they’re asking Form 16 document. Is there any problem if I can submit form 16 for zero tax ?…Please advise for this one.

There is no problem in submitting Form 16 for zero tax.

Is Employer Contribution to NPS to be reported in Gross Salary in Form 24Q return while reporting monthly deduction details.

Yes, to the extent it is taxable.

Dear Gautam, I am a central govt deductor. Some of our personnel were transferred in Jul last year. So, TDS for Q1 only was deducted. Now i am not able to generate Form 16 from TRACES as there was no entry made for them in TDS returns for Q4 of FY 2017-18. Is it possible to obtain Form 16 for these personnel? If so, how? Thanks in advance

The employees who featured in Q1 should have featured in Form 24 Q4 Annexure II for the Part A of Form 16 to be available on TRACES. Please refile Form 24Q for the fourth quarter with these employees shown in Annexure II.

Clear explanation for capturing no tds salary payments in Form 24Q. Very useful. Thanks.

Dear Gautam,

I am a Central Govt Deductor. Thanks very much for the prompt reply to my query dated 05 Jul 18 which helped me to issue Form 16. The query now is, for filing TDS returns for Q1 for FY 2018-19, should the TDS amounts for Mar & Apr 18 be added and filed as a single entity or shown separately? The payments for Mar 18 & Apr 18 have been credited and tax deducted on 02 Apr & 30 Apr 18 under a single BIN. Thanks in advance

Not sure what you mean by ” filed as a single entity.” Should you not be presenting employee-wise details of income and tax for each TDS challan in Form 24Q?

Dear Mr Gautam, my query was should the TDS amount for Mar 18 and Apr 18 for each employee be added and shown as a single amount (because there is a single BIN) or should it be shown as TDS deducted on 02 Apr 18 (for Mar 18 salary) and TDS deducted on 30 Apr 18 (for Apr 18 salary). Regards

I am not sure about this.

we have some contractual staff who receive the monthly amount from us without any TDS. Do we need to issue them Form 16 part B alone?

If you include such employees (zero tax deductees) in your Form 24Q filings, you can issue Form 16 with Part A and Part B. Else, you can issue a tax working sheet in the Part B format to such employees.

There is no mandatory requirement to issue Form 16 to such employees.

I am state government employees. I need of form No.16 of income tax for the year 2017-2018. But i am not tax payer i.e no tax had deducted my salary during the year 2017-2018. Thereafter this situation Can I issued form no.16 by the office to me.

Yes, your employer can issue Form 16 to you even if no tax was deducted from your salary.

Hi Gautham,

I have joined a company in October 2018. Am I eligible for getting a Form 16? or in other words when can I get one?

Please help me with this.

You are eligible to receive Form 16 from your employer.