State Bank of India (SBI) published the reference lending rates for the purpose of loan perquisite calculation for the financial year 2018-19 on its website a few days ago. You can find the SBI rates as on 01-Apr-2018 here.

SBI provides reference rates for different types of loan (home loan, car loan etc.). Employers should use the correct reference rate for the purpose of perquisite calculation. For example, if a car loan is provided to an employee, the reference rate for perquisite calculation shall be the SBI car loan rate.

Reference rate for personal loan provided to employees

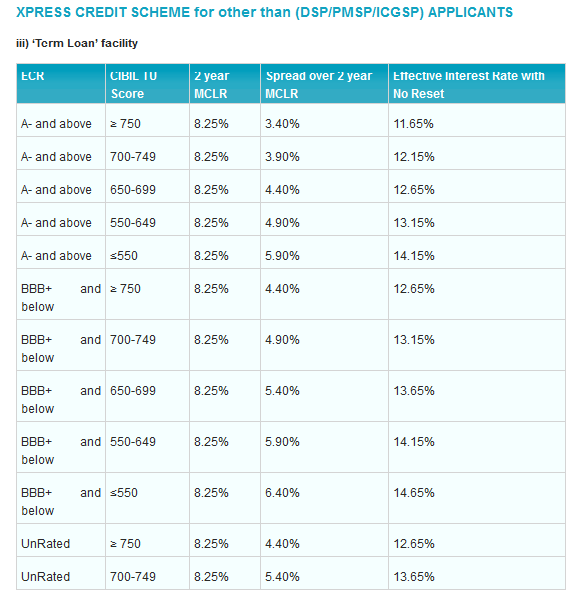

SBI’s loan product called “Xpress Credit” corresponds to personal loans provided by employers to their employees. Unlike last year (FY 2017-18) when SBI referred to 3 categories of reference rates – Full Check-off, Partial Check-off, and No Check-off, this year (FY 2018-19) the personal loan rates have been classified differently.

Let us take a look at the below table which presents personal loan rates which must be used by the large majority of the organizations for the purpose of perquisite calculation.

The table above presents the basis of which SBI determines the lending rate for an individual who applies for a personal loan with the bank. Any organization which uses the above table to determine the perquisite rate needs to know the following.

1. ECR – Refers to the employer’s credit rating.

2. CIBIL TU Score – Refers to the CIBIL score of the employee for whom the loan perquisite is sought to be determined.

For example, if your company’s credit rating is A- and the employee’s CIBIL score is 750, the reference rate for perquisite calculation shall be 11.65% for the year.

There are a few issues with the reference rates published by SBI.

1. For unrated companies, SBI does not provide reference rates if an employee’s CIBIL score is lower than 700. This probably means that SBI would not lend to an individual who works for an organization which has no credit rating and whose CIBIL score is lower than 700. But in reality, there are many unrated organizations which may provide loans to employees whose CIBIL rating may be lower than 700. What should be the reference rate for such instances?

2. SBI does not provide reference rates for employees who do not have CIBIL score. What should organizations do in such instances? It looks as though employers should ask employees to make an application to CIBIL and receive a score for the purpose of loan perquisite value calculation.

3. If an employee does not have a CIBIL score on account of insufficient credit history, what should be the reference rate?

The Income Tax Department should address the above issues and clarify on how employers should arrive at the perquisite rate for FY 2018-19 if an employee does not have a CIBIL score.

For personal loans, SBI publishes rates for a variety of its schemes such as XPRESS Credit, XPRESS Credit – IT Employees, and XPRESS Elite. This makes it complex for employers to identify the correct perquisite rate for its employees. Ideally, the Income Tax Department should simplify the process by publishing a single loan perquisite rate for all personal loans.

You can read about how to calculate perquisite value on loan provided to employees in this blog post.

2 Comments

Hi,

What we should consider in this case. Its too confusing.

Some organizations will probably use the highest rate (in the table) for employees who do not have CIBIL score.