The Income Tax Department has issued the “TDS on Salary” circular for FY 2016-17. You can take a look at it here.

Please ensure that all tasks (income tax deduction, investment proof scrutiny, etc.) related to salary TDS compliance in your organization for FY 2016-17 are carried out as per the circular.

Para 4.6.5 in the circular

This para states that the employer should receive and scrutinize documentary proof supporting investment declarations made by employees. Para 4.6.5 states:

To bring certainity and uniformity in this matter, section 192(2D) provides that person responsible for paying (DDOs) shall obtain from the assessee evidence or proof or particular of claims such as House rent Allowance (where aggregate annual rent exceeds one lakh rupees); Leave Travel Concession or Assistance; Deduction of interest under the head “Income from house property” and deduction under Chapter VI-A as per the prescribed form 12BB laid down by Rule 26C of the Rules.

In the above excerpt, the phrase “where aggregate annual rent exceeds one lakh rupees” in the context of collecting proof for providing House Rent Allowance (HRA) exemption is striking. To our knowledge the Rs 1 lakh cut-off is relevant only with regard to obtaining landlord PAN (or a no-PAN declaration by the landlord). However, this phrase gives one the impression that employer needs to collect proof (house rent receipt etc.) for providing HRA exemption only if the aggregate rent exceeds Rs 1 lakh. In other words, this seems to imply that employers need not collect any proof for HRA exemption in case the aggregate annual rent does not exceed Rs 1 lakh.

We are of the view that “where aggregate annual rent exceeds one lakh rupees” refers only to submission of landlord PAN and employers will have to collect house rent receipt even if the rent paid is less than Rs 1 lakh. As you may be aware, currently, employers need not collect rent receipts only if an employee receives a monthly amount of Rs 3,000 or less as house rent allowance.

Para 4.9 in the circular

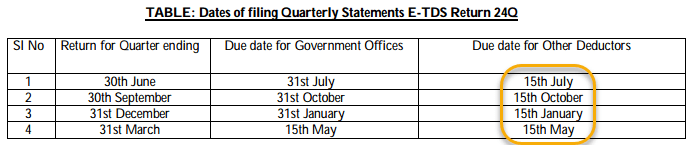

The due dates for Form No. 24Q filing, presented in the circular, seem to be incorrect. The circular presents the due dates for non-government deductors as follows.

However, the Income Tax Department, by way of a notification dated 29-Apr-2016, revised the due dates (with effect from 01-June-2016) for Form No. 24Q filing each quarter as follows.

| Quarter | Deadline |

|---|---|

| First quarter, ending 30th of June | Immediately following 31st of July |

| Second quarter, ending 30th of September | Immediately following 31st of October |

| Third quarter, ending 31st December | Immediately following 31st of January |

| Fourth quarter, ending 31st of March | Immediately following 31st of May |

The circular seems to contain the due dates which were in effect prior to the above notification.

Para 9.2 in the circular

According to para 9.2 in the circular, “rebate as per Section 87A upto Rs 2000/- to eligible persons (see para 6) may be given.”

This seems to be a mistake since the maximum rebate under Section 87A for FY 2016-17 is Rs 5,000 and not Rs 2,000. In fact para 6 (referred to in para 9.2) in the circular states the correct amount (Rs 5,000).

Suggestions

1. It would help if the Income Tax Department releases the salary TDS circular well ahead of the last quarter of the year. Many organizations initiate the process of investment proof scrutiny in January and hence need adequate time to study and implement the guidelines in the circular.

2. While it is fine to copy text from the previous year’s circular for the sake of convenience, it would help if the Income Tax Department does a thorough check on whether changes to income tax procedures for the current year are presented accurately in the circular.

2 Comments

Hi,

Happy New Year Gautham,

one query,

As per 192 TDS on salary is to be deducted on actual payment and not on accrual basis, here if a person resigns in Feb, his salary for the month of Jan and Feb is paid in April along with F&F settlement, then in which year it is accountable. As the payment is made in April.

Please take a look at this post – https://www.hinote.in/taxation-salary-payment-deferred.